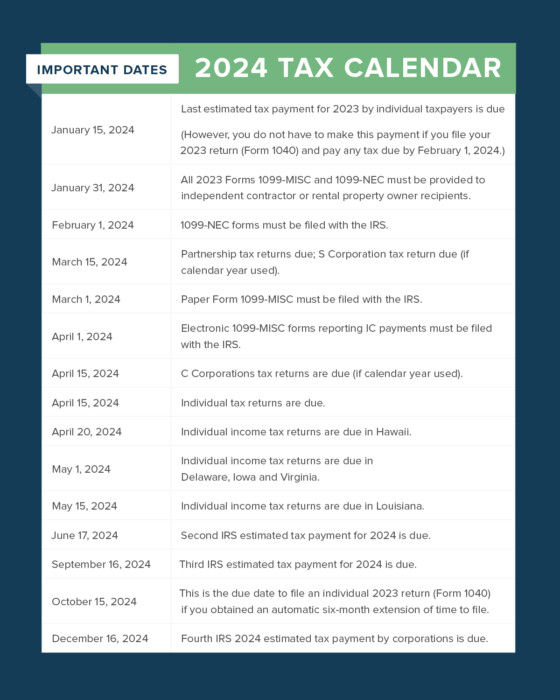

When Are 1099 Forms Due For The Calendar Year 2024 – From TDS deposit to TDS/ TCS certificates and challans to advance tax to audit report; here’s the complete list of activities you should complete in December . In November 2023 the IRS changed the threshold amounts for tax years 2023 and 2024 (taxes paid You should receive Form 1099-K by Jan. 31 if, in the prior calendar year, you received any .

When Are 1099 Forms Due For The Calendar Year 2024

Source : taxschool.illinois.edu

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

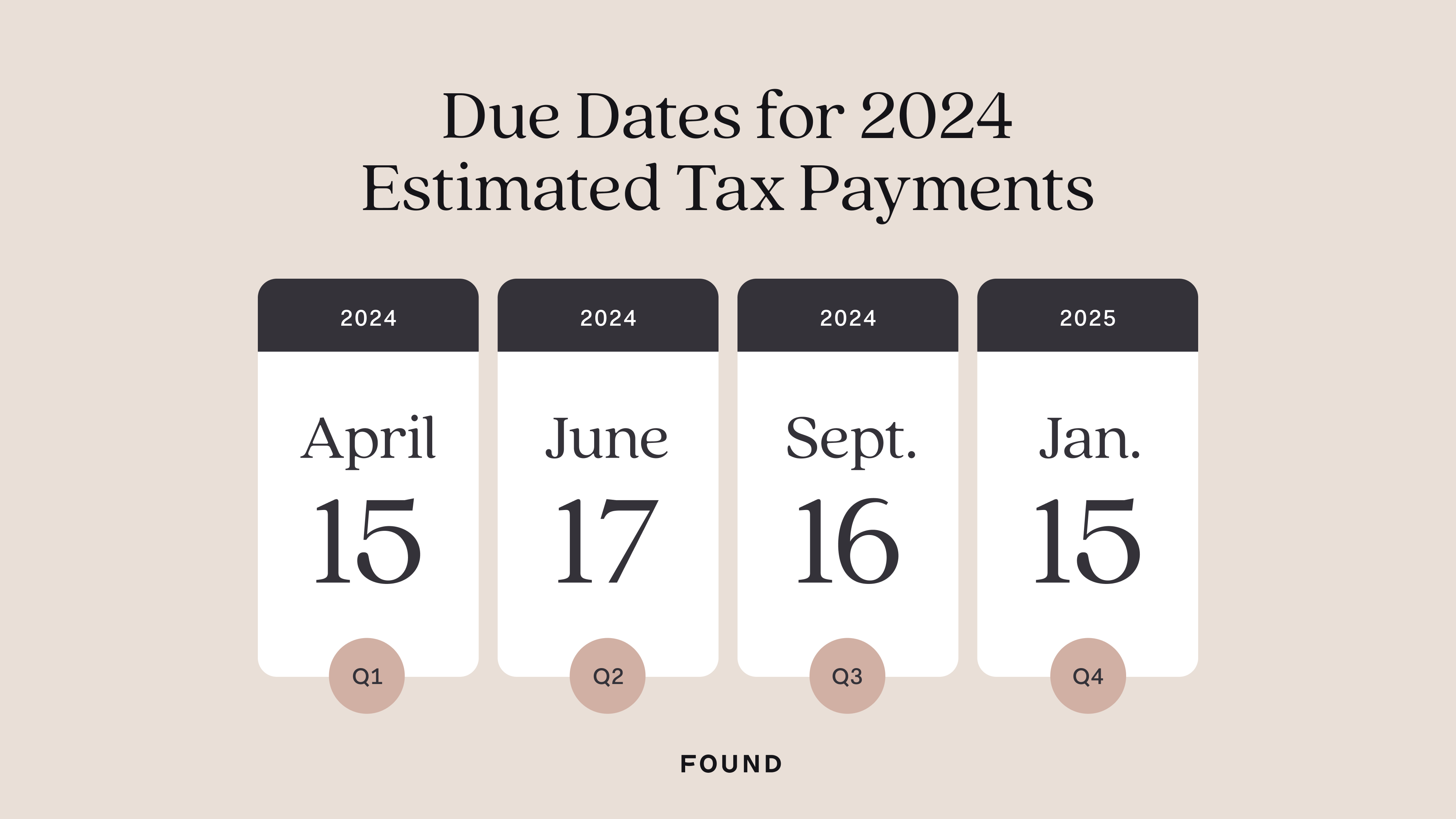

2024 Tax Deadlines for the Self Employed

Source : found.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

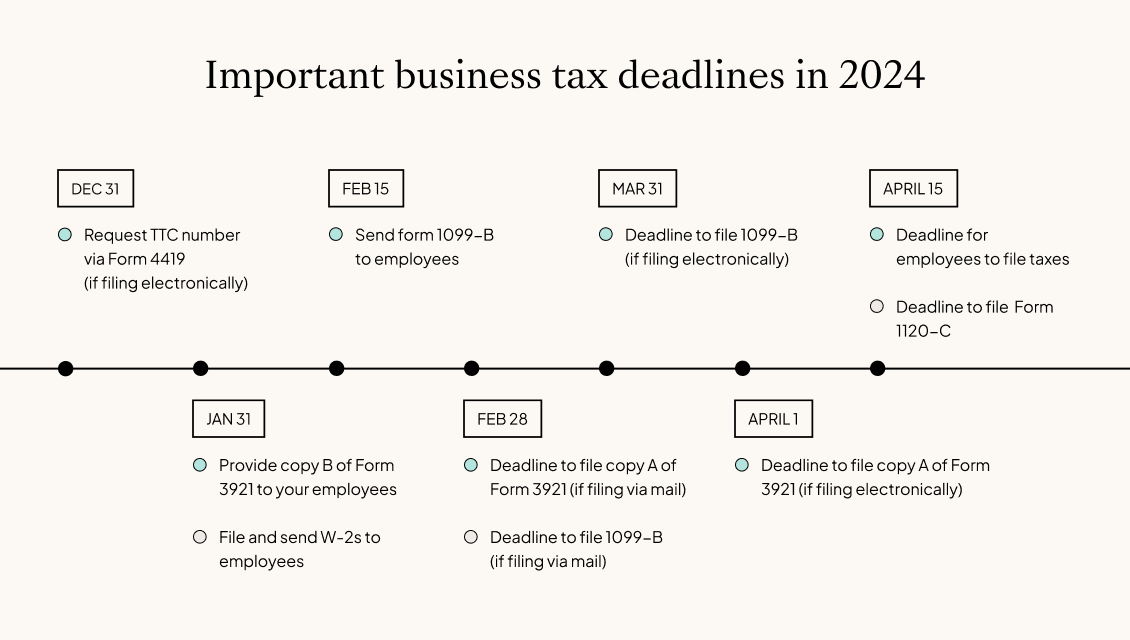

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

How to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com

Desk Pad Taxdate Calendar 2024 Item: #44 471

Source : www.tangiblevalues.com

2024 HR Compliance Calendar [Free Download]

Source : fitsmallbusiness.com

Without relief, more Forms 1099 K due in 2024 | Crowe LLP

Source : www.crowe.com

When Are 1099 Forms Due For The Calendar Year 2024 IRS Delays Implementation of 1099 K Filing Changes to Calendar : 2024. Form W-2 Form W-2 PR Form W-2 State Filings 1099 Series Forms The IRS requires 1099 Forms to be filed with the IRS each year to report certain types of payments that were made throughout the . Until ARPA was enacted, third-party settlement organizations were allowed a de minimis exception to filing Form 1099-K with respect to payees with 200 or fewer such transactions during the calendar .